Trading Tools

Essential Tools for Every Trader

Every trader needs the right set of tools to manage their portfolio—whether it’s an economic calendar, market news, or market outlook.

Whether you’re just starting out or already a seasoned pro, every trader needs their go-to tools. At Traze Andalan Futures, we provide a complete suite of essential trading tools—ranging from a real-time economic calendar and daily market news to sharp market outlooks. These are all designed to help you read the market more clearly, make faster decisions, and manage your account with greater confidence.

In the world of trading, precision isn’t optional—it’s your competitive edge.

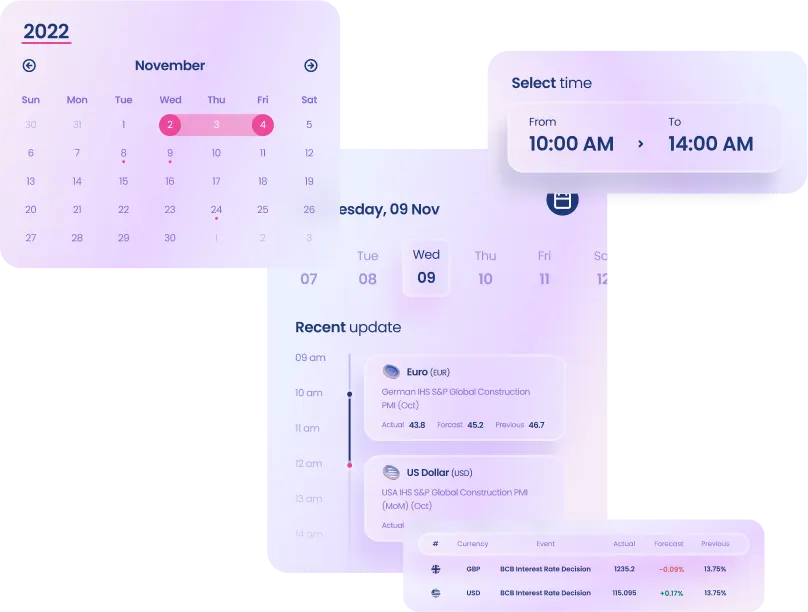

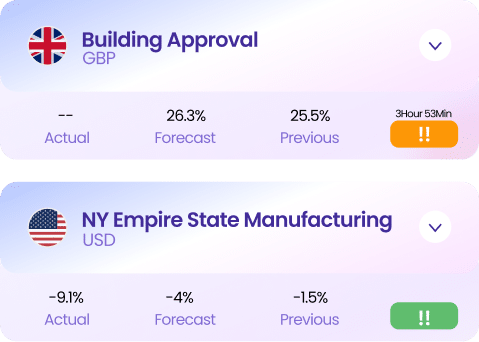

Economic Calendar

The economic calendar is one of the most vital tools for traders to monitor market developments. It lists key economic releases and scheduled events from around the world every day. This includes the name of the indicator, release time, analyst forecasts, and previous results.

Major events—such as the Non-Farm Payroll (NFP) report, retail sales data, or central bank rate decisions—can trigger significant price movements. That’s why traders are encouraged to check the calendar before trading, in order to anticipate potential volatility spikes and identify both opportunities and risks throughout the day.

Market News

Traze Market News delivers daily updates on global financial markets, covering everything from economic trends and central bank policy to investor sentiment and geopolitical developments. Each article is concise yet informative, helping traders quickly grasp critical information that impacts asset prices.

Our analyst team actively monitors trusted sources and filters the most relevant updates for traders. With a focused and objective approach, our market news helps you stay one step ahead—ready to adjust your strategy in real time as the market evolves.

Market Outlook

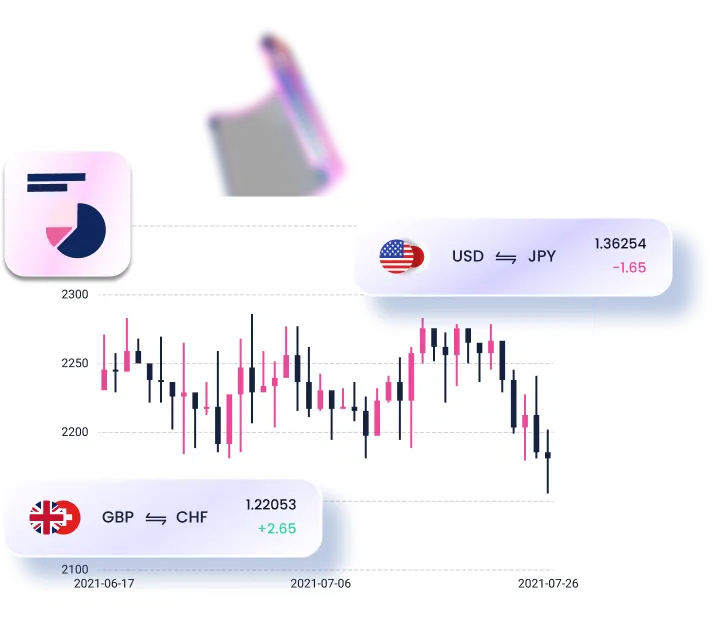

The Traze Market Outlook offers analytical insights into market direction using a combination of technical and fundamental data. This includes short- to medium-term trends across forex, indices, commodities, and global stocks—highlighting both opportunities and potential risks.

Backed by the professional insights of the Traze analyst team, traders receive a more strategic perspective for planning trades. The market outlook is designed to be a practical and actionable guide—helping you make more confident decisions in today’s fast-moving markets.

Start Trading Gold Today!

Take advantage of gold price movements with a reliable platform, fast registration process, and full support from Traze.